Following is an excerpt from Steve’s 3/31 presentation to transportation and logistics executives, hosted by Stifel’s equity research group.

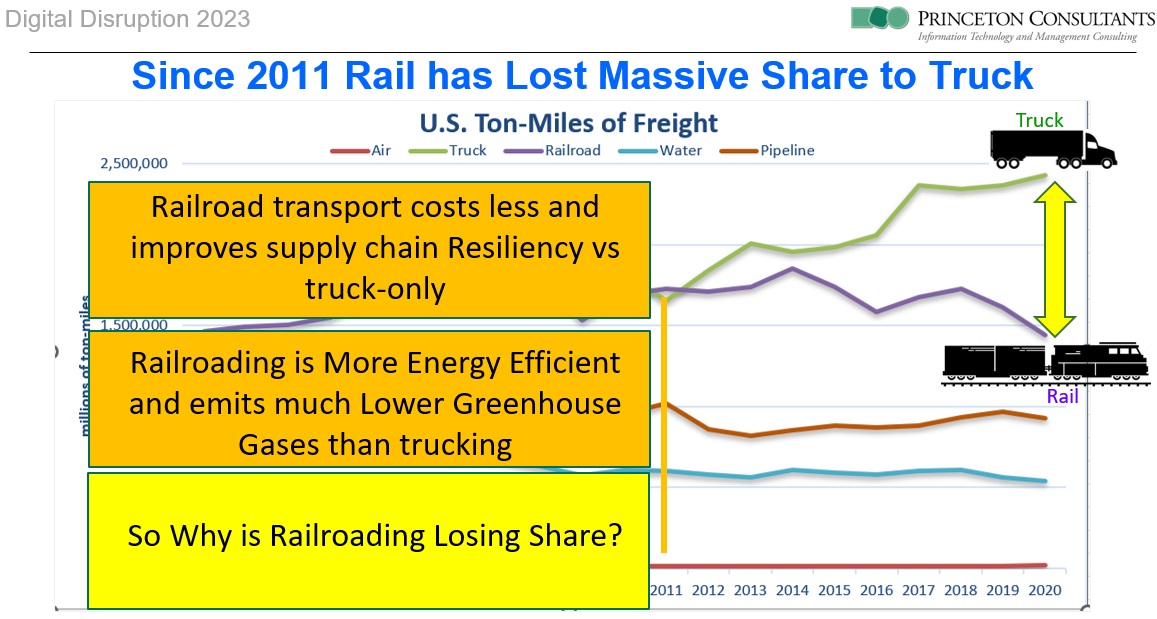

There are rail executives who talk about disruption because, starting around 2011, the railroads started to lose massive market share to trucking. The gap is presently widening. If rail transportation costs less and improves supply chain resiliency versus a truck-only strategy, and if it is more energy efficient and emits lower greenhouse gases than trucking does, why is it losing share?

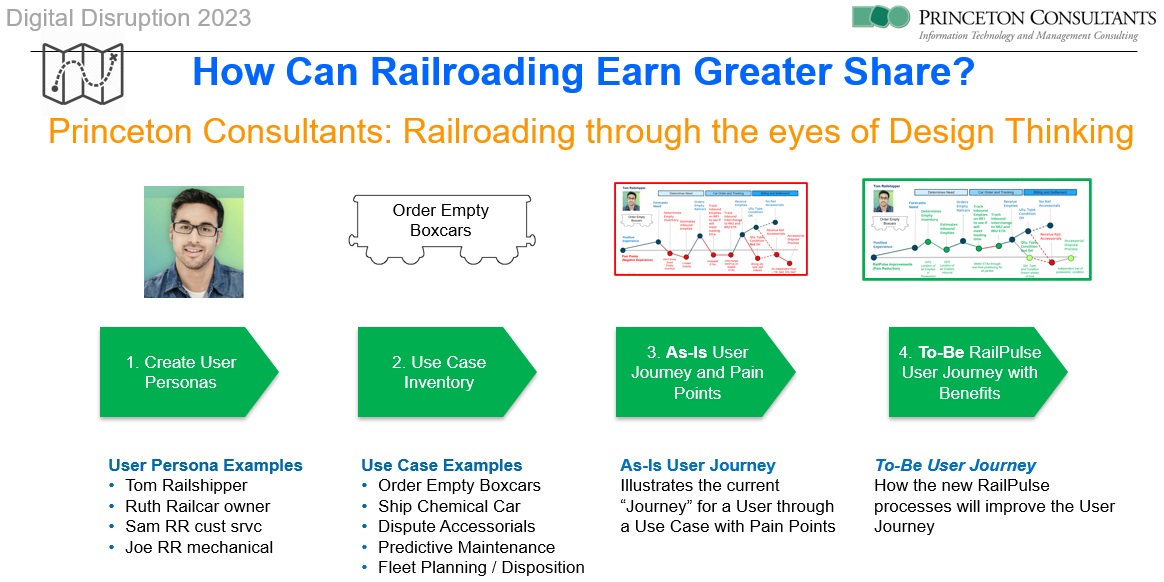

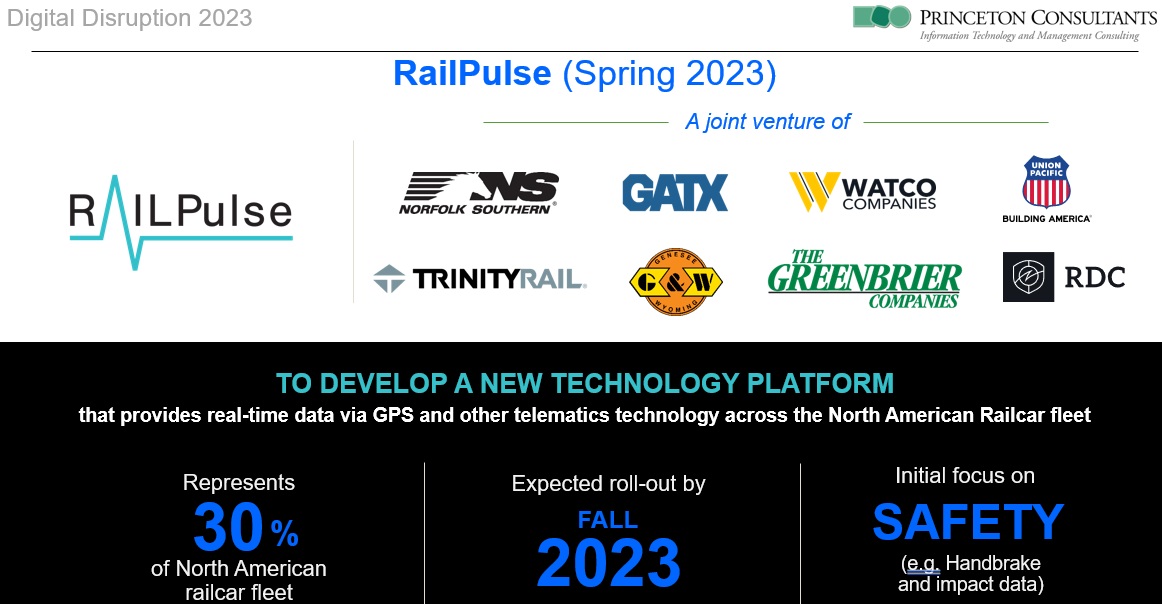

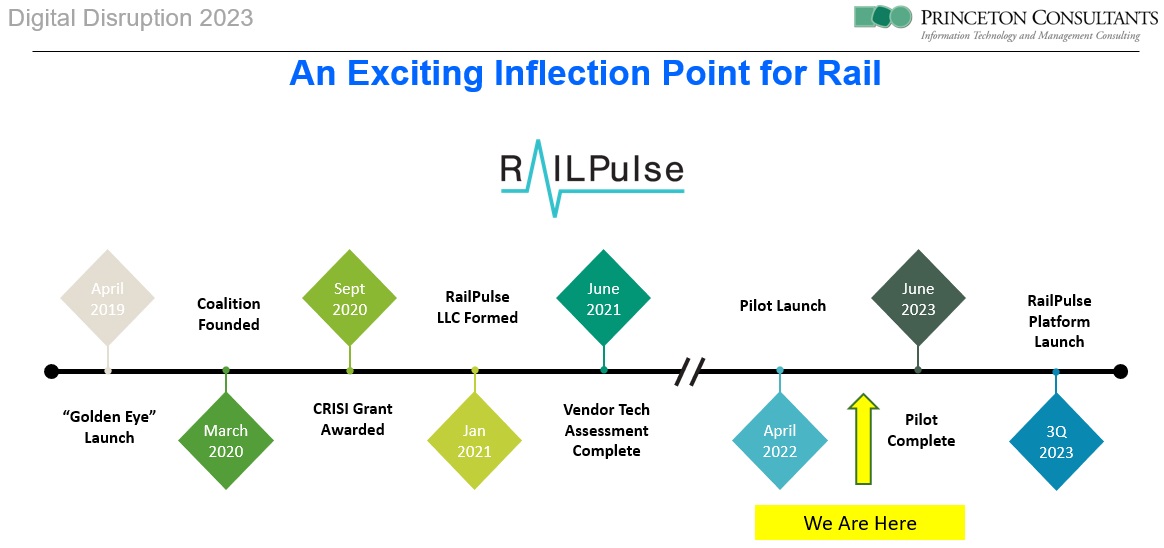

In response, Norfolk Southern Chief Strategy Officer Mike McClellan conceived RailPulse. Mike and several fellow rail leaders founded the RailPulse joint venture and hired Princeton Consultants to help diagnose where the problem was. We conducted design thinking activity, which I will briefly summarize along with stylized work-product images, not actual deliverables.

We created user personas like Tom Railshipper, Ruth Railcar Owner, Sam Customer Service Rep, and Joe Rail Mechanical. With these stakeholders, we ran different scenarios. In railroading, a common default scenario is that you have a loaded railcar running on the Class I track—that certainly is important, but not necessarily where the problems are. As shippers know, ordering empty railcars can be fraught. We mapped out the process, the pain points, and the problems, and we developed a vision. We ideated: “With some new technology, some new process, some new business model, or some combination of the three, how can we see a better world for each of these stakeholders?”

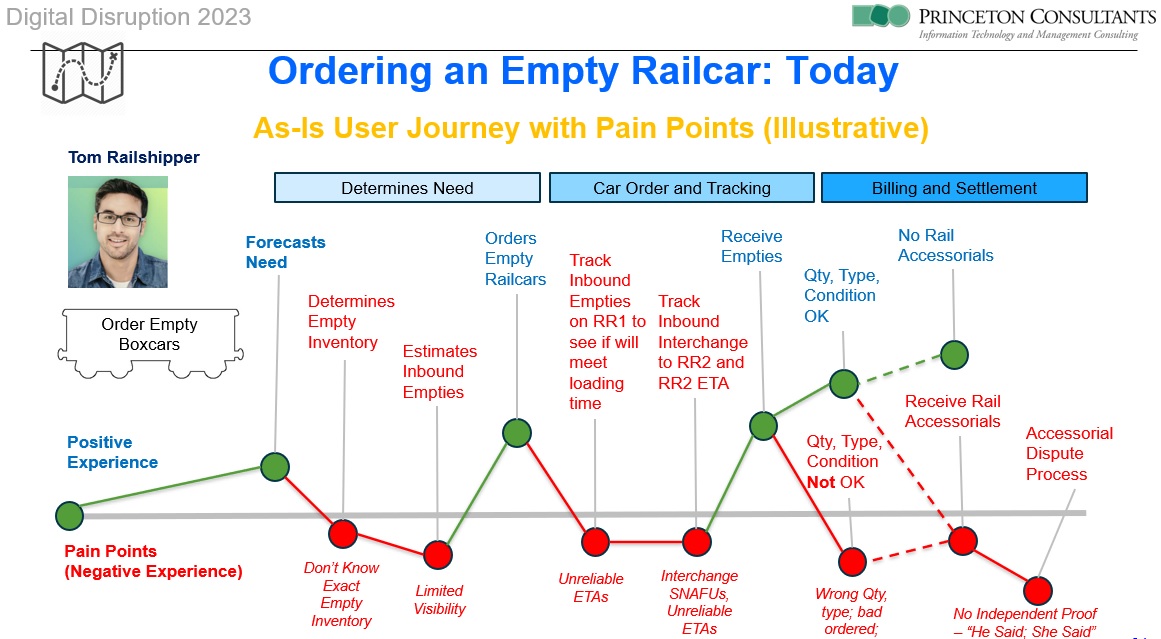

Next, we mapped the current journey. Moving from left to right, as Tom Railshipper we said, “I need some empty railcars. What’s the first pain point?”

We then said, “I don’t know exactly how many empty railcars I have right now in my big facility with lots of track. We do daily and weekly counts, but honestly, we are not always sure which cars are empty and which are full—and sometimes we lose cars. Another pain point is that we have limited visibility to what is inbound. We order the empty railcars we think we need and then they’re inbound, but sometimes on two different railroads. The main serving railroad might be a Class I and there is also a short line railroad, with a junction between them. At the interchange there can be a lack of visibility, with more pain points. Then we receive the empty. Sometimes we receive a railcar that is not what we wanted or thought we ordered, in which case unhappiness, accessorials, and disputes ensue.”

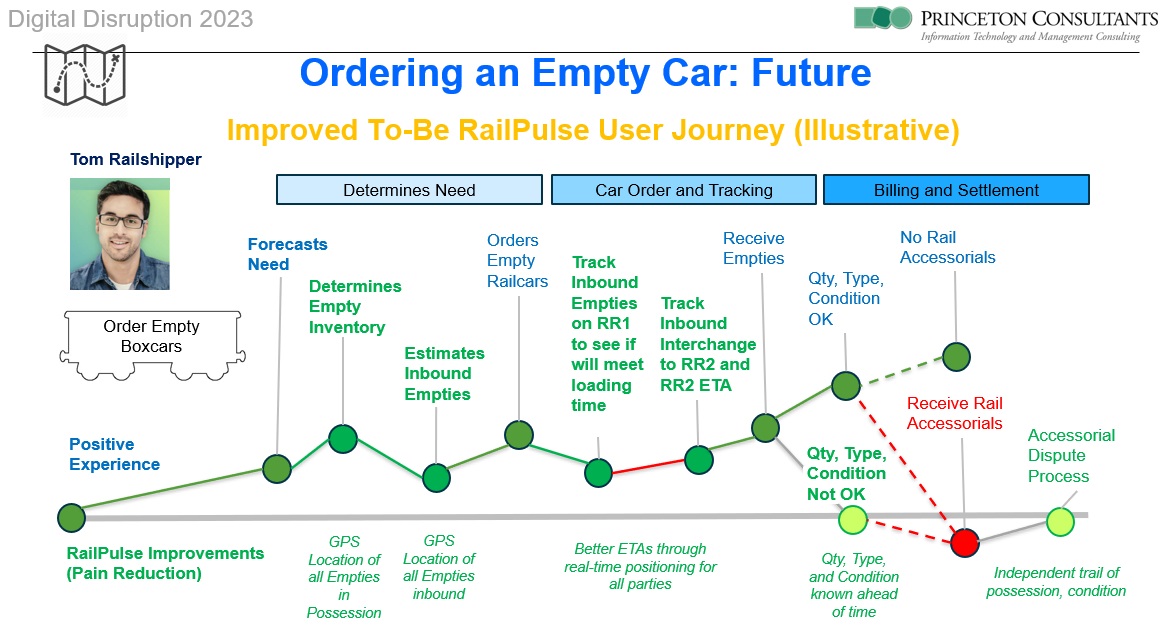

We ideated and mapped the happy path: “What if technology delivered little sensors on each railcar so you could know where it is, and whether it is loaded or empty?” With this magic wand, we ask, “How can this process be good for Tom Railshipper?” After all, if shippers want rail more, they will convert some loads from truck to rail.

Granted, there are some loads that will always go rail and some that will always go truck but, on the margin, there might be a sizable portion of freight that could be modally convertible.

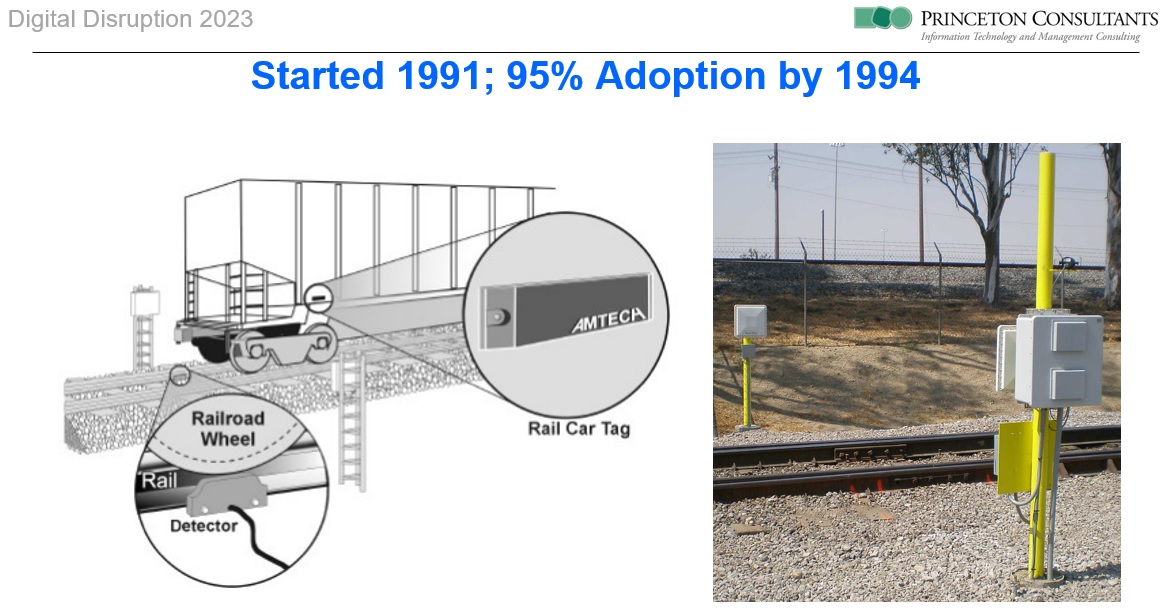

The last major technology innovation on railcars was the AEI tag, introduced around 1991. In only three years, that large-scale infrastructure project on private property was fully implemented, achieving 95 percent coverage. AEI tags were essentially early versions of E-ZPasses, using the same passive technology, without a battery. When an AEI tag on a railcar passes an active reader, the reader sends a signal that bounces off the AEI tag, which responds with its unique ID, thereby communicating that a specific railcar has passed. There is no information about the condition of the railcar nor control enabled and, until the railcar passes another reader, we do not see it. The AEI system is good for monitoring moving cars, especially on the main lines, but it is terrible for railcars at rest, at facilities, and in the first and last mile.

Disruptively, we asked, “What if we upgrade railcar technology from E-ZPass to smartphones?” In other words, upgrading to two‑way communications over the cellular network, with rechargeable batteries, multiple sensors, and open standards. This is the disruptive motivation behind RailPulse.

For RailPulse, there are three basic functional areas: location, condition, and health. For location, you can ping the railcar, receive lat/long, drop it in Google Maps, get the satellite view of roads and track, and zoom in. For condition, the status of the railcar might include if it is empty or loaded, if the doors are open or closed, as well as the temperature, moisture, and more. Health is largely related to anomalous events, such as when the hand brake is on but the railcar is moving.

As of Spring 2023, RailPulse is comprised of eight companies that have agreed to pick a standard and arm their entire fleets, which make up 30 percent of North American railcars. All new railcars will have RailPulse-compliant technology, and the existing fleets will be retrofitted.

The RailPulse joint venture is a not‑for‑profit creating open standards that allows the rail industry to expand. We are in the pilot phase, collecting data from all the vendors and presenting it to the RailPulse partners.

In Business, we typically look at our traditional competitor. In Rail that means an NS executive looks at CSX and vice versa, or a UP executive looks at BNSF and vice versa. The RailPulse partners are not exploring how to beat their usual competitors—they are thinking differently, disruptively, looking to increase rail transportation overall. This is about modal conversion: getting truck freight onto the railroads.

Now, if you are not in Rail but you are an executive at a transportation carrier or at a shipper, what does market growth expansion mean to you? Maybe if you are at a truckload carrier, it means winning some of the LTL freight back into your trucks as a multi‑stop or as a multi‑tenant. If you are at an LTL carrier, it might mean winning active freight from UPS and FedEx. If you are at UPS or FedEx you may want to win first- and last-mile van freight. Beyond modal, there are other dimensions, such as attracting premium customers that do not traditionally use your company or transportation segment. In exploring what those customers want, evaluate if emerging technologies can enable certain services at a reasonable cost.

In short, disrupt yourself! Reduce your overhead and operating costs with technology. Improve how smart you are as a buyer and seller in terms of setting prices, quantities, and timing. Technology is moving so quickly—maintain a bias for action.

To discuss this topic with Steve, email us to set up a call.